If you are considering opening a 529 system, it’s clever to keep it within the name on the guardian or little one. It’s counted in a A great deal lessen charge than 529 strategies owned by other relatives, minimizing the influence on the federal financial aid the student can qualify for.

Consider: While you can refinance equally federal and personal loans, refinancing federal student loans will cost you use of federal Advantages and protections — such as money-driven repayment plans and scholar loan forgiveness systems.

For those who have many withdrawals or charges, It's also wise to preserve a spreadsheet listing Every price, what it absolutely was for, the fee and when you acquire it.

Join and we’ll deliver you Nerdy content articles with regards to the income matters that subject most for you as well as other approaches that can assist you get far more from your cash.

In some cases, family members may end up having leftover 529 prepare funds — for example, probably the beneficiary chose a cheaper faculty, enlisted during the military, or didn’t go to school. In case you have unused funds sitting inside of a 529 program, here are some penalty-free of charge options to take into consideration:

Pupil loans guideFAFSA and federal university student aidPaying for job trainingPaying for collegePaying for graduate schoolRepaying college student debtRefinancing university student debtBest personal university student loans

There are sometimes limitations on what varieties of universities the beneficiary can show up at, so read through the plan documents meticulously right before contributing your money.

This strategy may aid if you’re working with the restrictions on 529 options, which usually do not allow you to fork out for some suitable expenses of attending university like transportation.

The Forbes Advisor editorial staff is impartial and objective. That will help guidance our reporting operate, and to continue our capacity to offer this written content without cost to our visitors, we acquire compensation from the businesses that advertise over the Forbes Advisor web-site. This compensation arises from two principal resources. Very first, we offer paid placements to advertisers to existing their gives. The payment we acquire for the people placements has an effect on how and the place advertisers’ gives appear on the website. This web site does not incorporate all companies or products accessible in the market. Second, we also involve one-way links to advertisers’ provides in a number of our articles; these “affiliate hyperlinks” might make money for our site whenever you click them.

Depleting the 529 account 1st can seem sensible for many people, suggests Gretchen Cliburn, a Qualified monetary planner and handling director at FORVIS.

View our house purchasing hubGet pre-accepted for any mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs get calculatorHow Substantially am i able to borrow home finance loan calculatorInspections and appraisalsMortgage lender opinions

“The tax credit rating is worth a lot more for every greenback of certified bills compared to the tax-absolutely free 529 strategy distribution, even thinking of The ten% tax penalty and ordinary earnings taxes on non-competent distributions,” claims Mark Kantrowitz, publisher and vp of research at Saving for College.

Bankrate.com is an impartial, promotion-supported publisher and comparison services. We are compensated in exchange for placement of sponsored products and services, or by you clicking on specified inbound links posted on our site. For that reason, this compensation may well effects how, exactly where and in what order click here items look in listing types, apart from where by prohibited by regulation for our home finance loan, dwelling fairness and various dwelling lending products and solutions.

Money contributed to 529 options may be invested, for example in mutual money and Trade-traded resources, to permit for possible progress eventually. As with any financial commitment, a 529 approach can encounter industry fluctuations which could have an impact on its benefit when it’s redeemed.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Patrick Renna Then & Now!

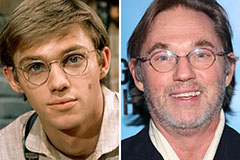

Patrick Renna Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Melissa Sue Anderson Then & Now!

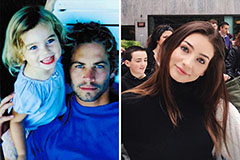

Melissa Sue Anderson Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!